How Amur Capital Management Corporation can Save You Time, Stress, and Money.

How Amur Capital Management Corporation can Save You Time, Stress, and Money.

Blog Article

Amur Capital Management Corporation Can Be Fun For Everyone

Table of ContentsSome Known Details About Amur Capital Management Corporation Amur Capital Management Corporation Can Be Fun For AnyoneSome Known Factual Statements About Amur Capital Management Corporation Amur Capital Management Corporation Fundamentals ExplainedAmur Capital Management Corporation Things To Know Before You BuyFacts About Amur Capital Management Corporation Uncovered

The firms we follow need a strong performance history commonly at the very least ten years of running history. This indicates that the company is most likely to have dealt with a minimum of one financial slump and that monitoring has experience with hardship in addition to success. We look for to leave out firms that have a debt high quality below investment quality and weak nancial strength.A firm's capability to increase returns continually can demonstrate protability. Firms that have excess money ow and solid nancial placements frequently pick to pay dividends to bring in and reward their investors.

The Only Guide to Amur Capital Management Corporation

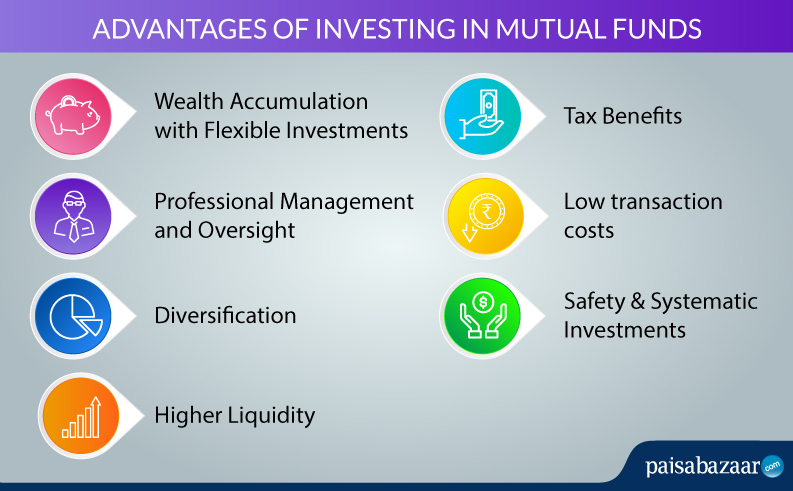

We have actually located these stocks are most at threat of cutting their rewards. Expanding your financial investment portfolio can assist protect against market uctuation. Take a look at the following variables as you prepare to expand: Your portfolio's property course mix is among the most vital aspects in establishing efficiency. Look at the dimension of a firm (or its market capitalization) and its geographical market U.S., developed worldwide or emerging market.

Regardless of exactly how easy electronic investment management platforms have actually made investing, it should not be something you do on an impulse. If you determine to enter the investing world, one point to take into consideration is how long you really desire to spend for, and whether you're prepared to be in it for the long haul - https://www.intensedebate.com/people/amurcapitalmc.

There's an expression common connected with investing which goes something along the lines of: 'the ball may drop, but you'll desire to make sure you're there for the bounce'. Market volatility, when monetary markets are fluctuating, is an usual phenomenon, and long-lasting could be something to aid ravel market bumps.

Fascination About Amur Capital Management Corporation

Joe invests 10,000 and gains 5% returns on this investment. In year two, Joe makes a return of 525, since not only has he made a return on his initial 10,000, but additionally on the 500 spent returns he has gained in the previous year.

The smart Trick of Amur Capital Management Corporation That Nobody is Talking About

One method you could do this is by taking out a Supplies and Shares ISA. With a Stocks and Shares ISA. accredited investor, you can invest up to 20,000 each year in 2024/25 (though this goes through transform in future years), and you don't pay tax on any returns you make

Beginning with an ISA is really easy. With robo-investing systems, like Wealthify, the tough job is provided for you and all you need to do is pick just how much to spend and select the threat level that matches you. It might be just one of minority instances in life where a much less emotional technique can be beneficial, but when it pertains to your funds, you might desire to pay attention to you head and not your heart.

Staying concentrated on your long-term goals might assist you to stay clear of irrational choices based on your emotions at the time of a market dip. The statistics do not exist, and long-term investing could feature many advantages. With a made up strategy and a long-lasting financial investment method, you might possibly expand also the tiniest amount of cost savings into a suitable amount of cash. The tax therapy relies on your specific circumstances and might go through alter in the future.

The Best Guide To Amur Capital Management Corporation

Nonetheless spending goes one step Read Full Article additionally, aiding you accomplish personal goals with 3 significant advantages. While conserving ways establishing apart part of today's money for tomorrow, spending methods placing your cash to function to potentially earn a better return over the longer term - investing for beginners in copyright. https://triberr.com/amurcapitalmc. Various courses of investment possessions cash money, fixed rate of interest, residential property and shares typically produce different levels of return (which is loved one to the threat of the investment)

As you can see 'Growth' assets, such as shares and property, have traditionally had the ideal general returns of all property classes yet have likewise had larger tops and troughs. As an investor, there is the potential to make resources growth over the longer term in addition to a continuous earnings return (like rewards from shares or rent out from a building).

Some Ideas on Amur Capital Management Corporation You Should Know

Rising cost of living is the recurring increase in the expense of living with time, and it can effect on our monetary wellness. One way to help surpass inflation - and produce favorable 'actual' returns over the longer term - is by investing in possessions that are not just efficient in delivering higher earnings returns but additionally provide the capacity for funding growth.

Report this page